riverside sales tax on food

This is the total of state county and city sales tax rates. The December 2020 total local sales tax rate was also 8750.

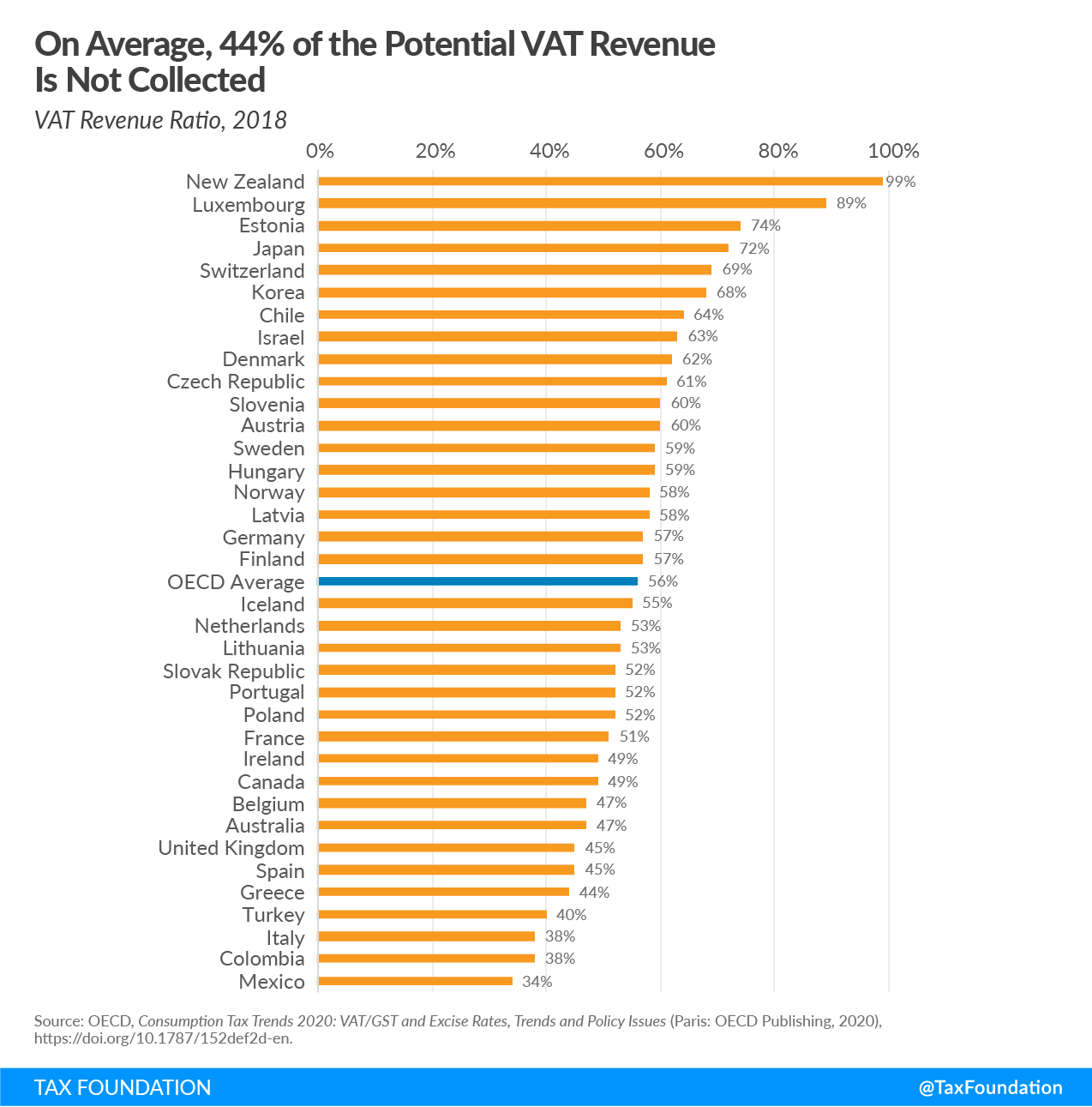

Australia Tax Income Taxes In Australia Tax Foundation

1000 Qualifying Food And Drug Tax.

. Riverside is located within Cook County IllinoisWithin Riverside there is 1 zip code with the most populous zip code being 60546The sales tax rate does not vary based on zip code. Higher sales tax than 72 of California localities 075 lower than the maximum sales tax in CA The 875 sales tax rate in Riverside consists of 6 California state sales tax 025 Riverside County sales tax 1 Riverside tax and 15 Special tax. Treat either candy or soda differently than groceries.

A non-fooddrink business would have to generate either 11000 or 14667 in sales for the village to recover the cost of the fee waivers. Prepared food means and includes any solid liquid both alcoholic. Look up 2022 sales tax rates for Riverside California and surrounding areas.

The Riverside sales tax rate is. 1788 rows California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. Riverside has a higher sales tax than 100 of Rhode Islands other cities and.

How does one register to collect file and pay the Local Meals and Beverage Tax. The December 2020 total local sales tax rate was also 7000. North Riverside IL 60546 Main.

Riverside CA Sales Tax Rate Riverside CA Sales Tax Rate The current total local sales tax rate in Riverside CA is 8750. The County sales tax rate is. Tax rates are provided by Avalara and updated monthly.

The amount of the tax is 2 and is placed on the owners of places for eating who can pass the tax along to consumers. Riverside is in the following zip codes. Total General Sales Tax.

Food and drugs city of riverside sales tax update notes q2 2014 sales per capita california as a whole excluding onetime payment aberrations the local one cent share of statewide sales and use tax was 52 higher than the second quarter of 2013. There are approximately 24711 people living in the Riverside area. The average cumulative sales tax rate in Riverside Illinois is 10.

Tax does not apply to sales of food products for human consumption except as provided in Regulations 1503 1574 and 1603. 92501 92502 92503. Arizona Georgia Louisiana Massachusetts Michigan Nebraska Nevada New Mexico South Carolina Vermont and Wyoming.

Riverside California Sales Tax Rate 2021 The 875 sales tax rate in Riverside consists of 6 California state sales tax 025 Riverside County sales tax 1 Riverside tax and 15 Special tax. The Riverside County California sales tax is 775 consisting of 600 California state sales tax and 175 Riverside County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund. Skip to main content Sales877-780-4848 Support Sign in Solutions Products Resources Partners About Blog Search.

You can print a 875 sales tax table here. The Missouri sales tax rate is currently. The Meals Beverage Tax rate is 1 on a business taxable food sales gross receipts.

Riverside is in the following zip codes. The minimum combined 2022 sales tax rate for Riverside Rhode Island is. The Riverside California sales tax is 875 consisting of 600 California state sales tax and 275 Riverside local sales taxesThe local sales tax consists of a 025 county sales tax a 100 city sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc.

Did South Dakota v. You can find more tax rates and allowances for Riverside County and California in the 2022 California Tax Tables. Eleven of the states that exempt groceries from their sales tax base include both candy and soda in their definition of groceries.

Twenty-three states and DC. Todd Pittenger May 12 2022. An alternative sales tax rate of 6625 applies in the tax region Beverly City which appertains to zip code 08075.

The Sales and Use Tax is the largest single revenue source for the General Fund. Tax rates are provided by Avalara and updated monthly. Kansas is getting rid of its state food sales tax on groceries.

The Rhode Island sales tax rate is currently. Sales Tax Breakdown Riverside Details Riverside CA is in Riverside County. You can print a 875 sales tax table here.

Sales and Use Tax. For tax rates in other cities see California sales taxes by city and county. The minimum combined 2022 sales tax rate for Riverside Rhode Island is 7.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. To register for the Local Meals and Beverage Tax a business must file the Business Application and Registration form to register for a Sales Tax account and receive a sales tax. Riverside County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Riverside County totaling 025.

This includes the rates on the state county city and special levels. The County sales tax rate is. The Riverside Illinois sales tax is 1000 consisting of 625 Illinois state sales tax and 375 Riverside local sales taxesThe local sales tax consists of a 175 county sales tax a 100.

Pedestrian Food Vendor CITY OF RIVERSIDE PEDESTRIAN FOOD VENDORS PERMIT APPLICATION 3900 MAIN ST RIVERSIDE CA 92522 PHONE 951-826-5465 FAX 951-826-2356 GENERAL INFORMATION OWNERS NAME If corporation use corporate name. For FY 201617 Sales and Use Tax represents 250percent of the total revenue budget. Riverside County Sales Tax Rates for 2022.

The revenue for FY 20 1617 is projected to increase by 54 percent for revenue of 666 million with FY 201718 revenue projected to. Governor Laura Kelly signed a bill Wednesday which will. Sales Tax Breakdown Riverside Details Riverside RI is in Providence County.

Look up the current sales and use tax rate by address Data Last Updated. The Riverside sales tax rate is. The Riverside New Jersey sales tax rate of 6625 applies in the zip code 08075.

Riverside RI Sales Tax Rate The current total local sales tax rate in Riverside RI is 7000.

Bid4assets Riverside County Ca Tax Defaulted Properties Auction

California Sales Tax Calculator Reverse Sales Dremployee

Guacamole Like Mother Like Daughter

Food And Sales Tax 2020 In California Heather

Riverside County Seller S Permits Ca Business License Filing Quick And Easy

Food And Sales Tax 2020 In California Heather

California Sales Tax Small Business Guide Truic

Food And Sales Tax 2020 In California Heather

California Food Tax Is Food Taxable In California Taxjar

Australia Tax Income Taxes In Australia Tax Foundation

Guide To Living In Medford Or Food Population Crime Average Salary Sales Tax In Medford Oregon Weather Data Basic Facts Economic Research

California Sales Tax Rate By County R Bayarea

All About California Sales Tax Smartasset

Review Victoria Sponge Cake At Yorkshire County Fish Shop In Epcot S Uk Pavilion The Disney Food Blog Fish And Chips Disney Food Victoria Sponge Cake

Food And Sales Tax 2020 In California Heather

Pin By Debbie Dinello On Restaurants To Try In 2022 Sides For Pork Chops Fried Shrimp Fried Fish